Let's Overshoot

Time for something different

“The economy” can seem like a confusing abstraction, but it’s simply how people try to get more of what they want. They invent new technologies, they work harder or smarter, they remake the land with cities, mines, and farms—and they fight each other. They organize into governments, businesses, investment funds, labor unions, homeowners’ associations, and even criminal gangs.

It’s impossible to understand what’s going on without understanding these entities, their motivations, and how they interact. Paying attention to the economy isn’t just for traders, central bankers, or academics, but for everyone who wants to be informed about the world.

And that’s where The Overshoot comes in.

If I had to pick one chart to tell the story of the U.S. economy since the end of WWII, it would be this:

The average American produced 2.2% more goods and services each year from the beginning of 1947 until the end of 2006. Despite violent business cycles and a range of countervailing forces,1 the U.S. economy always managed to stay within 8% of its stable long-term trend—until the financial crisis.

The defining feature of the crisis wasn’t the severity of the initial hit to incomes and production, but what happened next: nothing. There was no snapback. There was no “Morning in America.” The average American’s real income didn’t even return to its pre-crisis level until the middle of 2013.

The agonizingly slow growth after the crisis meant that, by the eve of the pandemic, U.S. output per person was 14% below where it would have been if the 1946-2006 trend had held steady. It was an enormous and costly undershoot. Put another way, the average American earned about $9,600 less in 2019 than would have been reasonably expected before the financial crisis.

Add those losses up across 330 million people for more than a decade, and that’s a lot of money to have left on the table. The result is that Americans have been living below their means—producing, consuming, and investing less than they otherwise could have—for 15 years.

And it was entirely unnecessary. There was no reason why American living standards had to stagnate when so many people were looking for work, so many factories were idle, and so many material desires were unfulfilled. It was a colossal waste.2

This isn’t just an American problem.

In April 2008, the International Monetary Fund published its projections for the world’s economies. Back then, the euro area was expected to grow by more than 12% from then until the end of 2013, while the world as a whole was expected to grow by almost 30%.

That didn’t happen. Instead, output fell sharply during the financial crisis and never returned to the expected path. By the eve of the pandemic, the world’s economic output was running 12% below its forecasted level. Each year, humanity was losing trillions of dollars of output compared to what reasonable people had expected before the crisis. That immiserated hundreds of millions of people and created openings across the world for a new generation of authoritarians.

It’s important to understand why that happened, and I fully expect to discuss the reasons in future pieces.3 History is the only evidence we have to test our ideas about how the world works.

But right now, I’m more concerned about the future.

While the undershoot of the past 15 years—and the damage it wrought on hundreds of millions of people’s lives—can’t be undone, we can try to make sure the next 15 years are better.4 Instead of living below our means, we can try to find out just how much we are capable of producing.

No one knows that limit, especially because businesses and workers have an amazing ability to adapt and innovate when the incentives are right. The only way to find our maximum potential is to aim higher than anyone thinks is possible.

That’s where I come in. I began my professional life by trying to understand the interplay between business, finance, and policy, and it’s what I’ve been doing ever since. If you subscribe to this newsletter, you will get to share in that process of discovery.

I’ll be tracking the constant grind of data on everything from retailers’ inventories to bank lending—and putting those numbers into context with informative charts, a sense of history, and a truly global perspective. I’ll do deep investigations into the big questions of how the economy and financial system work. And I’ll keep you informed on the major policy debates within central banks, finance ministries, and academia, as well as the impact of those policies on workers, businesses, and markets. For more on my background, what I’m offering, and why you should subscribe, check out the About page.

We need to overshoot. Let’s see what happens.

In 1940, only a quarter of U.S. adults had even finished high school. By 2020, more than 90% of American adults had finished high school and almost 40% had a 4-year college degree. Only 30% of American women were employed in the late 1940s, compared to almost 60% by the late 1990s. Since then, the female employment rate has essentially flat-lined.

The U.S. population structure has also changed significantly. The prime working age (25-54) share of the U.S. population fell from 42% to 35% during the Baby Boom, rose from that low to a peak of 44% by the late 1990s, and has since drifted down to 39% due to population aging.

Alongside these slow-moving structural changes, there were also large and sustained fluctuations in business investment, government spending on scientific research, taxation, regulation, and military spending.

On top of all that, there were big swings in the implied growth rate of productivity. Productivity—a function of innovation and the ability of businesses to commercialize that innovation—can’t be measured directly, so it’s defined as the unexplained “residual” in GDP growth after subtracting changes in the capital stock and labor supply. For a detailed breakdown, I recommend this recent paper from economists at the BEA and BLS.

Somehow, all of these dynamics managed to cancel each other out such that total output per American grew at a relatively steady rate until 2006. The slowdown in growth since then is due to a mix of fewer people working, reduced business investment, and a substantial slowdown in the unexplained residual (productivity). At least two out of those three forces were the consequences of suppressed spending on goods and services.

To be clear, there is nothing magical or predestined about the 1947-2006 trend. Take a look at footnote 1 and you can see why reasonable people might have thought that growth in the years since 2006 would be substantially slower than in the 60 years before. Yet the forecasters who had the job of accounting for those forces weren’t nearly so pessimistic at the time.

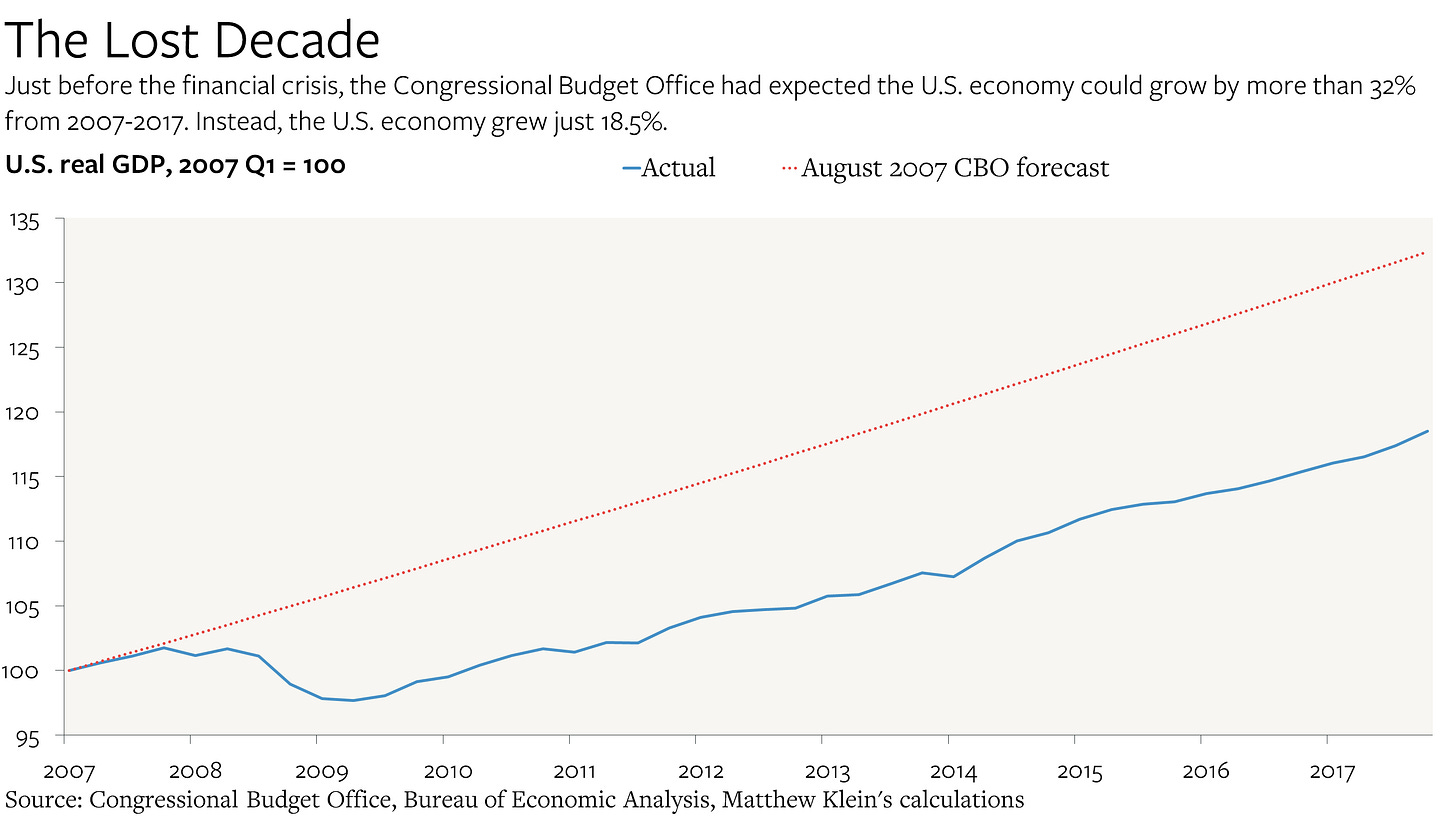

In August 2007, the Congressional Budget Office thought that the U.S. economy could grow about 32% by the end of 2017. In reality, American GDP only grew 18.5% over that period. In other words, U.S. economic output was 10.5% lower than what had been expected before the crisis by forecasters with a conservative track record.

The single most important cause was the global private sector’s inability to cut its debt burden through some combination of nominal income growth and restructuring. That, in turn, was largely due to a mix of overly tight fiscal policy, unreasonably tight monetary policy in a few places, and a general aversion to debt writedowns by creditors and their political allies.

High debt curtailed consumer spending power, which discouraged business investment and held down wages. This manifested in different ways in different places. There was a wave of foreclosures and state and local government budget cuts in the U.S. There was the euro crisis in Europe. And there was the wave of crises hitting various “emerging markets” after China began to unwind its 2008-10 stimulus.

Or, if not, at least they can be unpleasant in new and interesting ways.

go matt go!

Great to see you back. I'm a subscriber!